Claim Types

A fire loss to a home or business is among the most devastating and frequent. In many instances, a fire claim can be so severe that accurately adjusting the loss may seem impossible. Fire claims lead to many structural complications. Unfortunately, without guidance, these structural problems can be wrongly accounted for and misidentified. For example, in many instances smoke damage can appear on the brick exterior of homes. The insurance company may say that this can be cleaned. However, if smoke is trapped in between the drywall and the brick wall, the brick must be replaced. If this happens, the brick on your home may be out of production and would then require an entire rebricking of the exterior. The contents can be even more discouraging without proper service and guidance. Insurance companies require you to submit a full count inventory which means that you must account for every item affected by the fire, a process which can take months. At Brown O’Haver, we make these processes after a fire loss much easier and simple to deal with.

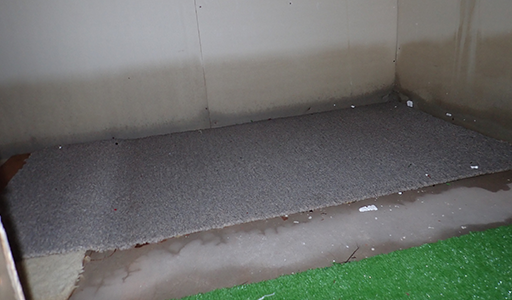

Water damage, on its surface, can seem to be relatively easy to mitigate. However, water can compromise many surfaces especially dry wall, wood, carpet, metal, and any textiles. Determining what is restorable and what is non-recoverable is tricky without understanding your options. Water leads to mold which can spread and ravage any surface. Proper inspection reimbursement and mitigation is essential to navigate any water claims.

Oklahomans are no stranger to wind and hail claims. On average, these claims only affect structure unless the damage is so severe that the interior was penetrated through windows or the roof. However, do be aware of these claims. Typically, many insurance policies only allow you to file for a wind claim or a hail claim. This is vital to understand because if you file for a claim for one, all damages for the other will not be accounted for. Therefore, having accurate advisory and assessment before filing the claim could mean the difference between a full roof and gutter replacement or a check for a few thousand dollars.

A theft claim is one of the more unrecognized claims but can have more than just monetary effects on a policy holder. Theft and vandalism can cause irreversible harm, affecting extremely sentimental items that cannot be replaced. Furthermore, a large majority of personal property affected by theft and vandalism can be extremely valuable. Because of this, many items require their own separate insurance policy or are excluded beneath the fine print of a policy. Furthermore, theft and vandalism claims can have unexpected complications with depreciation. Many items that thieves target are immune to depreciation or, in fact, appreciate. Seeking expert advice during this situation is crucial to receive peace of mind and accurate compensation.

Flood claims are much less frequent but just as devastating as other losses. Floods can wash away personal property or, if strong enough, destroy parts of the structure as well. Floods can leave lingering water over longer periods of time which cause irreparable damage to structure and personal property. Unfortunately, damage from floods can only be covered if you have a flood policy. The coverages may differ in flood policies and more exclusions could apply. If you reside in a flood prone area, please understand what you are covered for and seek expert advice if you believe a flood insurance policy is necessary.